Small Businesses in Canada Deserve Better

Many old and new businesses will try to get a loan from a bank, but this is often a waste of time. Along with guarding your money, banks guard a few secrets. Firstly, they won’t tell you that the larger they are, the longer you will have to wait for everything, from meeting with an advisor to getting approval to receiving the financing. Secondly, if you apply for a loan at a bank you’ve worked with before, you won’t receive any special benefits for your loyalty. Thirdly, banks often reject small business loans because the loans aren’t a profitable financial product for them.

Since thousands of good businesses can’t get the funding they need from a bank, many go to alternative lenders and get overcharged. At Lendified, we stand behind our belief that small Canadian companies need to be treated better. You should be able to get fast and straightforward financing without overpaying. That is why Lendified offers:

Refinancing

Pay off old debt faster with a leaner and meaner loan that answers your needs.

Cash Flow

Handle surprise equipment failures and low sales with a short-term loan.

Inventory & Sourcing

Stay ahead of customer demands when working capital is hard to come by.

Billing & Supplier Payment

Maintain good relations with your suppliers and pay bills on time with this loan.

Equipment

Replace obsolete machinery or get it repaired with our specially designed financing solutions.

Relocation & Expansion

Open a new branch, or move to the other side of town without worrying about the costs.

Hiring & Training

Add experts to your team and provide thorough training programs with the help of this loan.

Advertising & Promotion

Create campaigns to get the word out about your fantastic new business!

Retail

Stay up to date with the latest trends, or open a new branch with the help of a Lendified business loan.

Auto Dealer

Need a little cash to entertain clients while they wait for their car? Lendified has the right loan for you!

Spa and Salon

Gain peace of mind knowing our small business loans can help you expand your services, hire top talent, and promote your brand.

Restaurants

With a business loan, Lendified can serve up some serious dough to get your restaurant, pub, bistro, or ice cream parlour thriving.

Construction

Build a better tomorrow for your company and clientele by applying for a small business loan.

Other Industries

Whether you’re a business in Canada with seven months under your belt or have been around for years, Lendified helps businesses in many industries.

Trusted by Entrepreneurs Across Canada

Greenhouse Juice Company

Health foods company

“At Greenhouse, we have a very clear value proposition for our customers… At Lendified, their offer is similarly clear: to provide fast and efficient access to money to help businesses like us grow. It has been a pleasure working with Lendified — not only have they delivered on every aspect of their promise, but they have begun drinking our juice at the office! We couldn’t be happier with our Lendified experience.” – Hana

Taste of the Mediterranean

Restaurant

“Great people to work with. We have received several loans from Lendified for our expansion. Their simple and quick process made it easy for us to qualify and their rates have been lower than other online lenders. We highly recommend them.”- Sam

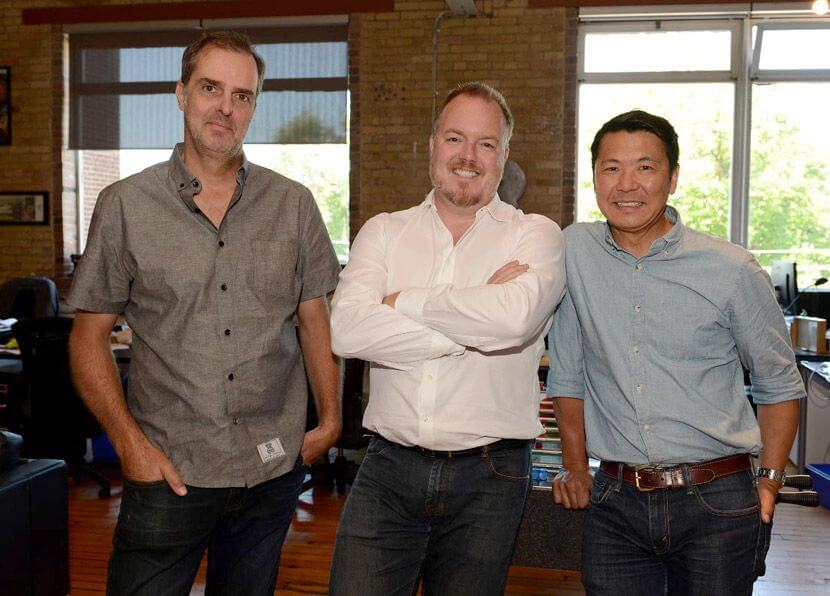

Resonator

Media agency

“As owners of a small, fast growing communications business, meeting our customer commitment of delivering quality work is something we stand behind. This sometimes requires investing in upfront resources or equipment to meet project specifications – before we get paid by the client. It’s reassuring to know that Lendified is there to help us get a capital loan when we need it…” – Chris